Chinese Bank With $100 Billion In Assets Is Bailed Out

by Tyler Durden

Sun, 07/28/2019 - 16:57

Step aside Baoshang Bank, it's time for Chinese bank bailout #2.

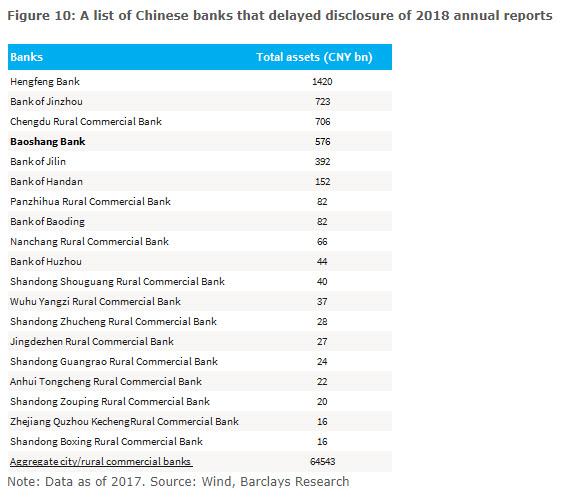

Last Thursday, when reporting on the imminent failure of yet another Chinese bank in the inglorious aftermath of Baoshang Bank's late May state takeover, we dusted off a list of deeply troubled Chinese financial institutions that had delayed their 2018 annual reports...

... and noted that the #2 bank on this list, Bank of Jinzhou - with some $105 billion in total assets - recently met financial institutions in its home Liaoning province to discuss measures to deal with liquidity problems, and in a parallel bailout to that of Baoshang, the bank was in talks to "introduce strategic investors" after a report that China’s financial regulators are seeking to resolve its liquidity problems sent its dollar-denominated debt plunging.

Fast forward just three days later, when said failure-cum-bailout is now official: three months after Baoshang Bank was seized by the government in a historic first, Bank of Jinzhou was just bailed out, winning government-backed "reinforcement" on Sunday as three state-controlled financial institutions said they would take at least 17.3% in the troubled lender, whose shares have been suspended since April.

Industrial and Commercial Bank of China (ICBC), the country’s largest lender by assets, China Cinda Asset Management and China Great Wall Asset Management, two of China’s four largest distressed debt managers, said on Sunday they would take stakes in Bank of Jinzhou, Reuters reports.

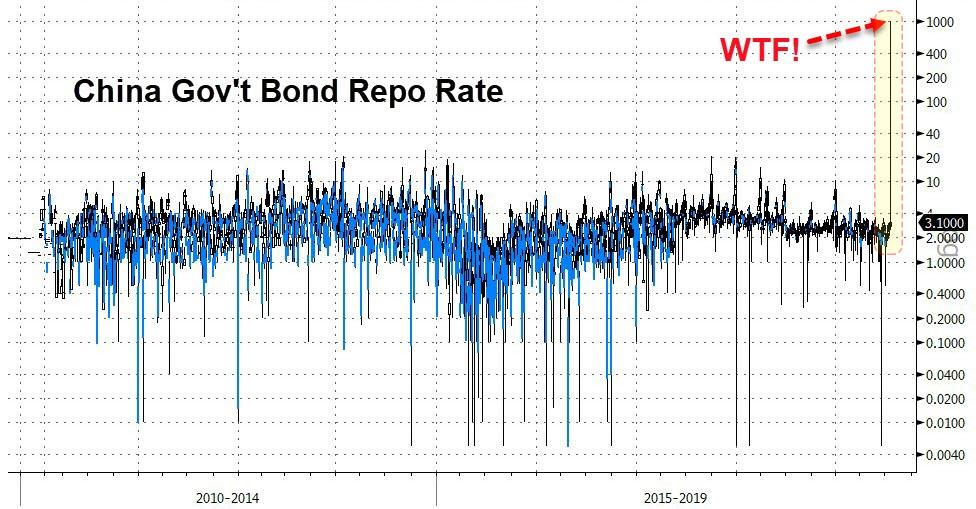

To avoid further repo market lockups and freezing in the interbank funding market where in a freak incident, the Chinese government bond repo rate last Friday shot up to a whopping 1,000%...

... and amid rising concerns about the bank's viability and potential bank runs, Jinzhou said on Thursday it was in talks with multiple parties for possible investments.

As part of the rescue package, ICBC’s ICBC Financial Asset Investment unit signed an equity transfer agreement to invest up to 3 billion yuan ($436 million) in a 10.82% stake of Bank of Jinzhou, it said in a statement filed to the Shanghai Stock Exchange. Hours after the state lender’s announcement, Cinda said in a statement to the Hong Kong Stock Exchange that its wholly owned Cinda Investment Co would invest in a 6.49% stake in Bank of Jinzhou, though it didn’t give the value of the deal.

China Great Wall also said it would take a stake in Bank of Jinzhou, according to a statement sent to Reuters. It did not elaborate on the value of the deal or the size of the stake.

The investments come as regulators scramble to diversify their approach to supporting highly indebted smaller banks and contain financial risks.

On Friday, Reuters reported that China’s banking and insurance regulator told the country’s biggest distressed debt managers to prepare contingency plans to take over or invest in high-risk small and medium-sized Chinese banks as fractures in the inter bank funding market emerged.

“The investment is to serve country’s supply-side reform in the financial sector and enhance the bank’s capability to serve the real economy,” the ICBC said in its statement. The deal will be conducted with the unit’s own funds, ICBC added.

Back in May, a shock government-led takeover of the little-known (at the time) Baoshang Bank revived concern about the health of hundreds of small lenders as the slowing economy results in more sour loans, testing their capital buffers and draining their reserves.

“For Baoshang Bank, the government took a state takeover, while for Bank of Jinzhou, the government introduced some state-owned strategic investors,” said Dai Zhifeng, analyst with Zhongtai Securities Co; in reality both were government rescues, only in the latest case Beijing used state-owned bank intermediaries.

“The latter approach is more market-oriented and showcased the determination of regulators to resolve problematic banks, while injecting confidence into the market,” Dai said, although when stripped of all the pig lipstick, what just happened in China is that another major bank, one with $100 billion in assets, just collapsed and received a government-backed rescue. For how this impacts the overnight funding market, keep a close eye on various Chinese repo rates once the market opens.

Source: Zero Hedge

______________________________________________________

If you wish to contact the author of any reader submitted guest post, you can give us an email at UniversalOm432Hz@gmail.com and we'll forward your request to the author.

______________________________________________________

All articles, videos, and images posted on Dinar Chronicles were submitted by readers and/or handpicked by the site itself for informational and/or entertainment purposes.

Dinar Chronicles is not a registered investment adviser, broker dealer, banker or currency dealer and as such, no information on the website should be construed as investment advice. We do not support, represent or guarantee the completeness, truthfulness, accuracy, or reliability of any content or communications posted on this site. Information posted on this site may or may not be fictitious. We do not intend to and are not providing financial, legal, tax, political or any other advice to readers of this website.

Copyright © 2019 Dinar Chronicles

by Tyler Durden

Sun, 07/28/2019 - 16:57

Step aside Baoshang Bank, it's time for Chinese bank bailout #2.

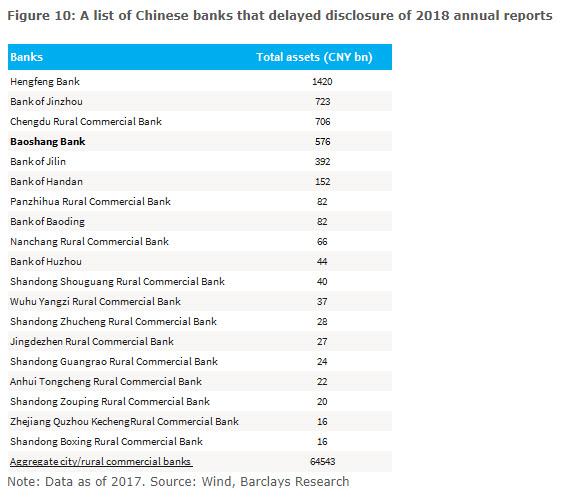

Last Thursday, when reporting on the imminent failure of yet another Chinese bank in the inglorious aftermath of Baoshang Bank's late May state takeover, we dusted off a list of deeply troubled Chinese financial institutions that had delayed their 2018 annual reports...

... and noted that the #2 bank on this list, Bank of Jinzhou - with some $105 billion in total assets - recently met financial institutions in its home Liaoning province to discuss measures to deal with liquidity problems, and in a parallel bailout to that of Baoshang, the bank was in talks to "introduce strategic investors" after a report that China’s financial regulators are seeking to resolve its liquidity problems sent its dollar-denominated debt plunging.

Fast forward just three days later, when said failure-cum-bailout is now official: three months after Baoshang Bank was seized by the government in a historic first, Bank of Jinzhou was just bailed out, winning government-backed "reinforcement" on Sunday as three state-controlled financial institutions said they would take at least 17.3% in the troubled lender, whose shares have been suspended since April.

Industrial and Commercial Bank of China (ICBC), the country’s largest lender by assets, China Cinda Asset Management and China Great Wall Asset Management, two of China’s four largest distressed debt managers, said on Sunday they would take stakes in Bank of Jinzhou, Reuters reports.

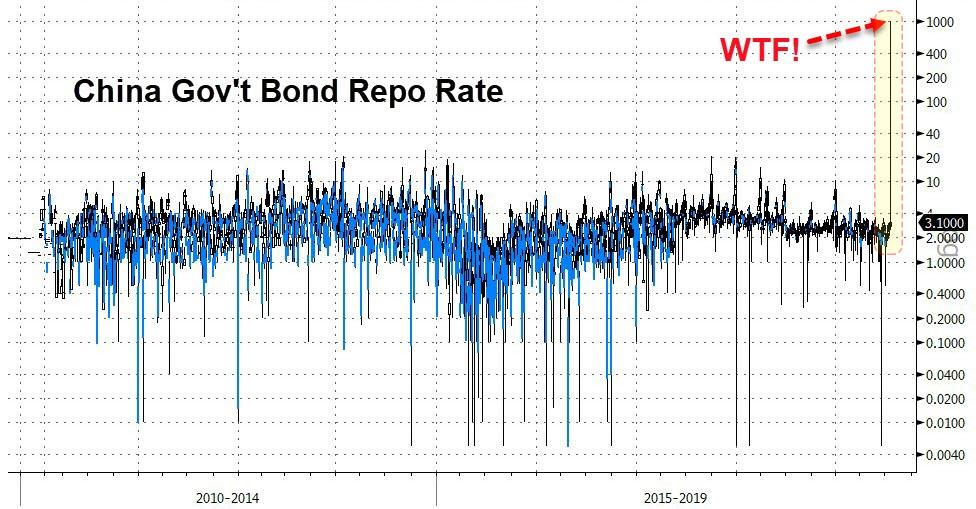

To avoid further repo market lockups and freezing in the interbank funding market where in a freak incident, the Chinese government bond repo rate last Friday shot up to a whopping 1,000%...

... and amid rising concerns about the bank's viability and potential bank runs, Jinzhou said on Thursday it was in talks with multiple parties for possible investments.

As part of the rescue package, ICBC’s ICBC Financial Asset Investment unit signed an equity transfer agreement to invest up to 3 billion yuan ($436 million) in a 10.82% stake of Bank of Jinzhou, it said in a statement filed to the Shanghai Stock Exchange. Hours after the state lender’s announcement, Cinda said in a statement to the Hong Kong Stock Exchange that its wholly owned Cinda Investment Co would invest in a 6.49% stake in Bank of Jinzhou, though it didn’t give the value of the deal.

China Great Wall also said it would take a stake in Bank of Jinzhou, according to a statement sent to Reuters. It did not elaborate on the value of the deal or the size of the stake.

The investments come as regulators scramble to diversify their approach to supporting highly indebted smaller banks and contain financial risks.

On Friday, Reuters reported that China’s banking and insurance regulator told the country’s biggest distressed debt managers to prepare contingency plans to take over or invest in high-risk small and medium-sized Chinese banks as fractures in the inter bank funding market emerged.

“The investment is to serve country’s supply-side reform in the financial sector and enhance the bank’s capability to serve the real economy,” the ICBC said in its statement. The deal will be conducted with the unit’s own funds, ICBC added.

Back in May, a shock government-led takeover of the little-known (at the time) Baoshang Bank revived concern about the health of hundreds of small lenders as the slowing economy results in more sour loans, testing their capital buffers and draining their reserves.

“For Baoshang Bank, the government took a state takeover, while for Bank of Jinzhou, the government introduced some state-owned strategic investors,” said Dai Zhifeng, analyst with Zhongtai Securities Co; in reality both were government rescues, only in the latest case Beijing used state-owned bank intermediaries.

“The latter approach is more market-oriented and showcased the determination of regulators to resolve problematic banks, while injecting confidence into the market,” Dai said, although when stripped of all the pig lipstick, what just happened in China is that another major bank, one with $100 billion in assets, just collapsed and received a government-backed rescue. For how this impacts the overnight funding market, keep a close eye on various Chinese repo rates once the market opens.

Source: Zero Hedge

______________________________________________________

If you wish to contact the author of any reader submitted guest post, you can give us an email at UniversalOm432Hz@gmail.com and we'll forward your request to the author.

______________________________________________________

All articles, videos, and images posted on Dinar Chronicles were submitted by readers and/or handpicked by the site itself for informational and/or entertainment purposes.

Dinar Chronicles is not a registered investment adviser, broker dealer, banker or currency dealer and as such, no information on the website should be construed as investment advice. We do not support, represent or guarantee the completeness, truthfulness, accuracy, or reliability of any content or communications posted on this site. Information posted on this site may or may not be fictitious. We do not intend to and are not providing financial, legal, tax, political or any other advice to readers of this website.

Copyright © 2019 Dinar Chronicles

0 Comments: