Wells Fargo: Get Out As Long As You Can

Jul. 19, 2019 9:08 AM ET

Achilles Research

Summary

Wells Fargo - Second Quarter Earnings Overview

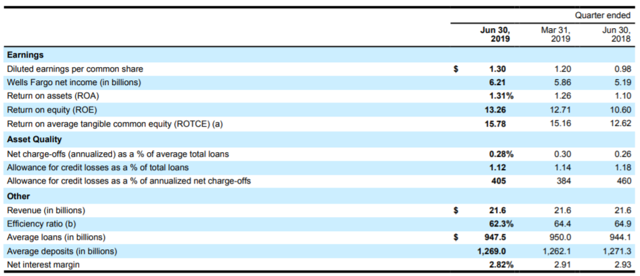

Wells Fargo reported $21.6 billion in revenues for the second quarter, which was the same amount the bank reported in the year-ago quarter. The reported revenue figure nonetheless beat the consensus revenue estimate of $20.9 billion.

Wells Fargo said it earned $6.2 billion in Q2-2019, reflecting an increase of ~20 percent year-over-year. In terms of earnings per share, Wells Fargo pulled in $1.30/share compared to $0.98/share in the year-ago period. Wall Street analysts expected the bank to report earnings of $1.18/share.

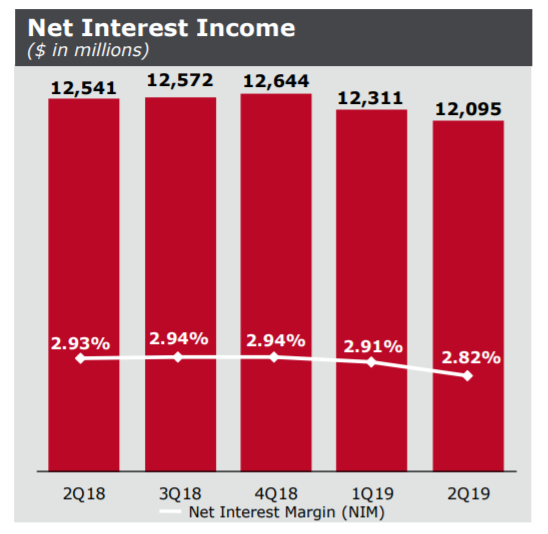

Here's an earnings snapshot.

Source: Wells Fargo Earnings Release

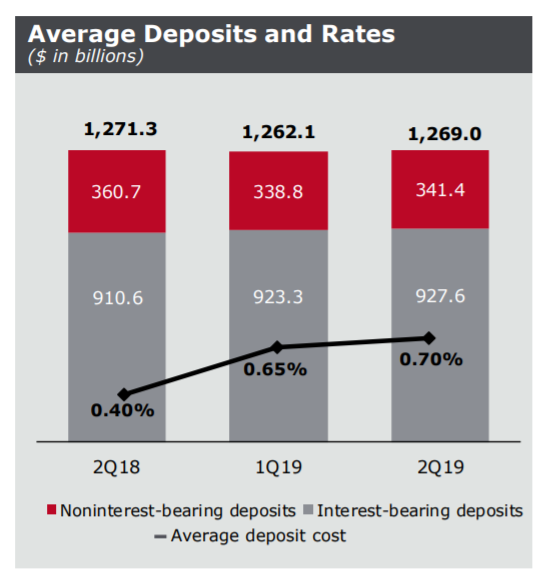

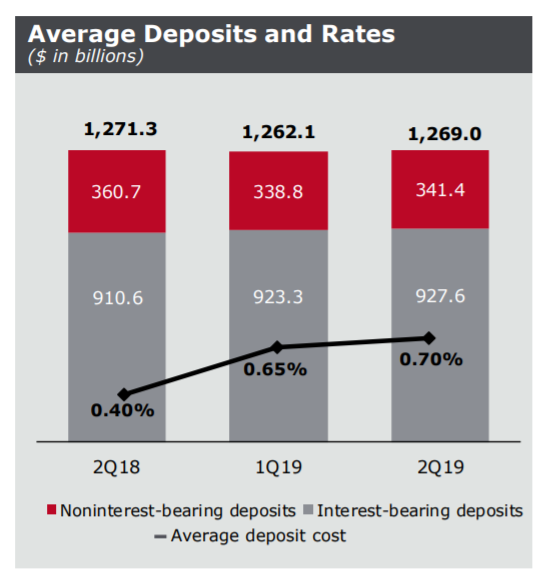

Wells Fargo's deposit base hit $1,269 billion in Q2-2019, reflecting an increase of $6.9 billion or 1 percent over the previous quarter. Year-over-year, Wells Fargo's deposits dropped $2.3 billion as clients in the Wealth and Investment Management and Wholesale Banking businesses invested more money into higher-yielding investments.

Source: Wells Fargo

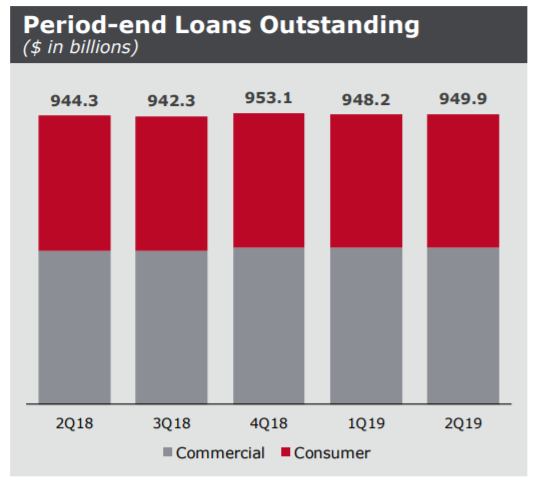

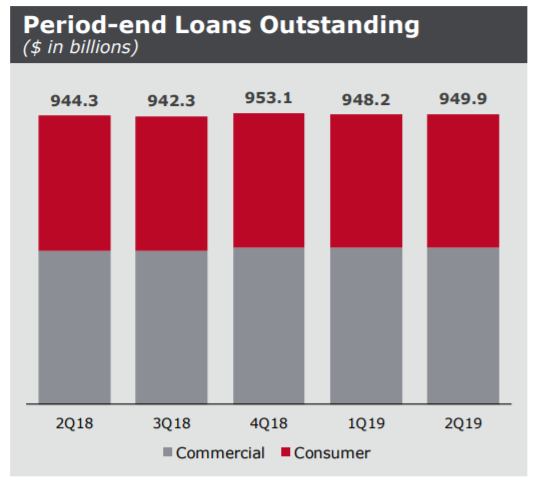

Wells Fargo's period-end outstanding loans totaled $949.9 billion, reflecting $5.6 billion, or 1.0 percent growth year-over-year driven by growing demand for first mortgage loans and industrial/commercial loans.

Source: Wells Fargo

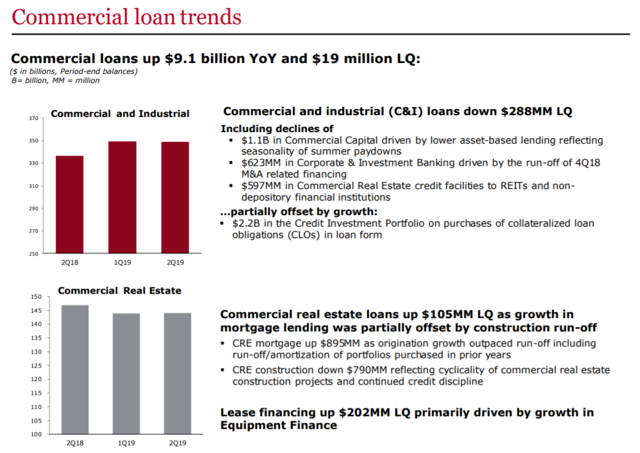

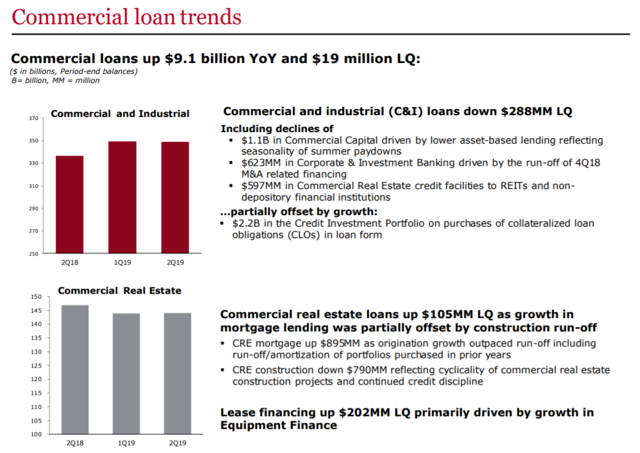

The bank's commercial loans jumped $9.1 billion in the second quarter, reflecting strong fundamentals in the U.S. economy. I expect Wells Fargo's commercial loan base to continue to grow in the low-to-mid single digits going forward... as long as the U.S. economy doesn't fall into a recession.

Source: Wells Fargo

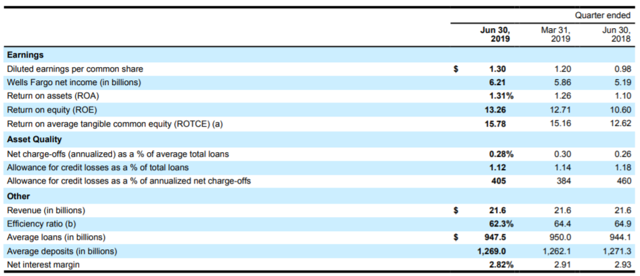

Net Interest Income

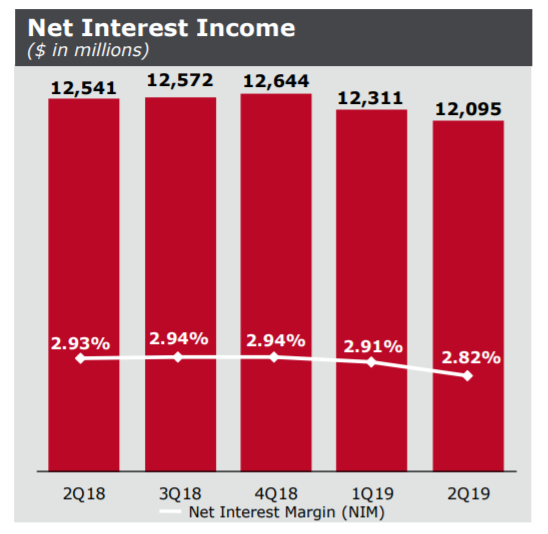

Declining net interest income is a big deal for banks, not just Wells Fargo.

If the Fed raises short-term interest rates, banks like Wells Fargo with huge loan businesses get to charge their customers more money. Falling interest rates, on the other hand, are a big red flag for investors because rate cuts imply downward pressure on net interest income and total earnings.

Wells Fargo's net interest income in the second quarter totaled $12.1 billion, reflecting a decrease of $446 million or 4 percent compared to the year-ago period. The reason: Falling short-term interest rates. The lower rates go, the less money Wells Fargo makes on its loans. Wells Fargo's NII growth trend started to reverse in Q1-2019 and I expect things to get a lot worse for Wall Street banks if the Fed moves to end the current rate hiking cycle this month.

Source: Wells Fargo

The outlook for Wells Fargo's net interest income is indeed quite negative. According to the bank's conference call, Wells Fargo's Chief Financial Officer John Shrewsberry said:

Last quarter, we said we expected net interest income to decline 2% to 5% this year compared with 2018 and if the rate environment we are in today persists, we would expect to be near the low-end of the range or near 5%.

If U.S. economic growth slows, which is likely after a ten-year expansion, and the Fed implements rate cuts, Wells Fargo could see an ongoing, maybe even accelerating decline in its net interest income.

Capital Returns

On a more positive note, Wells Fargo is returning significant amounts of capital to shareholders. Wells Fargo currently pays shareholders a $0.45/share quarterly dividend, which increased ~15 percent year-over-year. Wells Fargo is now proposing to return even more capital to shareholders over the coming twelve months:

The Company expects to increase its third quarter 2019 common stock dividend to $0.51 per share from $0.45 per share, subject to approval by the Company's Board of Directors. The plan also includes up to $23.1 billion of gross common stock repurchases, subject to management discretion, for the four-quarter period from third quarter 2019 through second quarter 2020.

Valuation

Wells Fargo is one of the largest commercial banks in the world and has been one of Warren Buffett's favorite stocks. Wells Fargo's price-to-book-multiple, however, started to contract in September 2016 when the bank was embroiled in a fake account scandal.

Today, Wells Fargo's shares sell for 1.17x accounting book value, which is still the highest price-to-book-multiple in its peer group of commercial banks.

Data by YCharts

Market Risks

Lower short-term rates are a major red flag for bank investors because they imply declining net interest income for banks. A falling rate environment will likely dramatically limit Wells Fargo's upside potential. A decline in short-term interest rates paired with slowing economic growth would be the worst of all scenarios. A downturn in the U.S. economy would negatively affect Wells Fargo's credit quality, charge-off ratio, and likely limit the bank's loan and deposit growth.

Your Takeaway

It's time to get out of bank stocks when net interest incomes start to drop off and banks explicitly warn of further declines. The end of the current rate hiking cycle is near, and banks will suffer in a lower rate environment, including Wells Fargo. If a U.S. recession also manifests itself, bank investors are looking at considerable downside potential. I am not going to touch any bank investments with a ten-foot pole in the near future.

Source: Seeking Alpha

______________________________________________________

If you wish to contact the author of any reader submitted guest post, you can give us an email at UniversalOm432Hz@gmail.com and we'll forward your request to the author.

______________________________________________________

All articles, videos, and images posted on Dinar Chronicles were submitted by readers and/or handpicked by the site itself for informational and/or entertainment purposes.

Dinar Chronicles is not a registered investment adviser, broker dealer, banker or currency dealer and as such, no information on the website should be construed as investment advice. We do not support, represent or guarantee the completeness, truthfulness, accuracy, or reliability of any content or communications posted on this site. Information posted on this site may or may not be fictitious. We do not intend to and are not providing financial, legal, tax, political or any other advice to readers of this website.

Copyright © 2019 Dinar Chronicles

Jul. 19, 2019 9:08 AM ET

Achilles Research

Summary

- Wells Fargo released second quarter earnings on Tuesday.

- The bank beat on earnings and revenues.

- However, Wells Fargo's net interest income dropped.

- I still believe this is the end of the current rate hiking cycle.

- Wells Fargo does not make an attractive value proposition.

Wells Fargo - Second Quarter Earnings Overview

Wells Fargo reported $21.6 billion in revenues for the second quarter, which was the same amount the bank reported in the year-ago quarter. The reported revenue figure nonetheless beat the consensus revenue estimate of $20.9 billion.

Wells Fargo said it earned $6.2 billion in Q2-2019, reflecting an increase of ~20 percent year-over-year. In terms of earnings per share, Wells Fargo pulled in $1.30/share compared to $0.98/share in the year-ago period. Wall Street analysts expected the bank to report earnings of $1.18/share.

Here's an earnings snapshot.

Source: Wells Fargo Earnings Release

Wells Fargo's deposit base hit $1,269 billion in Q2-2019, reflecting an increase of $6.9 billion or 1 percent over the previous quarter. Year-over-year, Wells Fargo's deposits dropped $2.3 billion as clients in the Wealth and Investment Management and Wholesale Banking businesses invested more money into higher-yielding investments.

Source: Wells Fargo

Wells Fargo's period-end outstanding loans totaled $949.9 billion, reflecting $5.6 billion, or 1.0 percent growth year-over-year driven by growing demand for first mortgage loans and industrial/commercial loans.

Source: Wells Fargo

The bank's commercial loans jumped $9.1 billion in the second quarter, reflecting strong fundamentals in the U.S. economy. I expect Wells Fargo's commercial loan base to continue to grow in the low-to-mid single digits going forward... as long as the U.S. economy doesn't fall into a recession.

Source: Wells Fargo

Net Interest Income

Declining net interest income is a big deal for banks, not just Wells Fargo.

If the Fed raises short-term interest rates, banks like Wells Fargo with huge loan businesses get to charge their customers more money. Falling interest rates, on the other hand, are a big red flag for investors because rate cuts imply downward pressure on net interest income and total earnings.

Wells Fargo's net interest income in the second quarter totaled $12.1 billion, reflecting a decrease of $446 million or 4 percent compared to the year-ago period. The reason: Falling short-term interest rates. The lower rates go, the less money Wells Fargo makes on its loans. Wells Fargo's NII growth trend started to reverse in Q1-2019 and I expect things to get a lot worse for Wall Street banks if the Fed moves to end the current rate hiking cycle this month.

Source: Wells Fargo

The outlook for Wells Fargo's net interest income is indeed quite negative. According to the bank's conference call, Wells Fargo's Chief Financial Officer John Shrewsberry said:

Last quarter, we said we expected net interest income to decline 2% to 5% this year compared with 2018 and if the rate environment we are in today persists, we would expect to be near the low-end of the range or near 5%.

If U.S. economic growth slows, which is likely after a ten-year expansion, and the Fed implements rate cuts, Wells Fargo could see an ongoing, maybe even accelerating decline in its net interest income.

Capital Returns

On a more positive note, Wells Fargo is returning significant amounts of capital to shareholders. Wells Fargo currently pays shareholders a $0.45/share quarterly dividend, which increased ~15 percent year-over-year. Wells Fargo is now proposing to return even more capital to shareholders over the coming twelve months:

The Company expects to increase its third quarter 2019 common stock dividend to $0.51 per share from $0.45 per share, subject to approval by the Company's Board of Directors. The plan also includes up to $23.1 billion of gross common stock repurchases, subject to management discretion, for the four-quarter period from third quarter 2019 through second quarter 2020.

Valuation

Wells Fargo is one of the largest commercial banks in the world and has been one of Warren Buffett's favorite stocks. Wells Fargo's price-to-book-multiple, however, started to contract in September 2016 when the bank was embroiled in a fake account scandal.

Today, Wells Fargo's shares sell for 1.17x accounting book value, which is still the highest price-to-book-multiple in its peer group of commercial banks.

Data by YCharts

Market Risks

Lower short-term rates are a major red flag for bank investors because they imply declining net interest income for banks. A falling rate environment will likely dramatically limit Wells Fargo's upside potential. A decline in short-term interest rates paired with slowing economic growth would be the worst of all scenarios. A downturn in the U.S. economy would negatively affect Wells Fargo's credit quality, charge-off ratio, and likely limit the bank's loan and deposit growth.

Your Takeaway

It's time to get out of bank stocks when net interest incomes start to drop off and banks explicitly warn of further declines. The end of the current rate hiking cycle is near, and banks will suffer in a lower rate environment, including Wells Fargo. If a U.S. recession also manifests itself, bank investors are looking at considerable downside potential. I am not going to touch any bank investments with a ten-foot pole in the near future.

Source: Seeking Alpha

______________________________________________________

If you wish to contact the author of any reader submitted guest post, you can give us an email at UniversalOm432Hz@gmail.com and we'll forward your request to the author.

______________________________________________________

All articles, videos, and images posted on Dinar Chronicles were submitted by readers and/or handpicked by the site itself for informational and/or entertainment purposes.

Dinar Chronicles is not a registered investment adviser, broker dealer, banker or currency dealer and as such, no information on the website should be construed as investment advice. We do not support, represent or guarantee the completeness, truthfulness, accuracy, or reliability of any content or communications posted on this site. Information posted on this site may or may not be fictitious. We do not intend to and are not providing financial, legal, tax, political or any other advice to readers of this website.

Copyright © 2019 Dinar Chronicles

0 Comments: